Customer in focus

Customer’s voice

Satisfaction level surveys (NPS)

At Alior Bank, we carefully listen to the voice of Customers, including thanks to regular surveys of their satisfaction using the NPS (Net Promoter Score) method. These surveys encompass both the surveys of general satisfaction level with working with the Bank, and satisfaction level of service for particular products or distribution channels.

NPS relationship surveys, carried out every quarter of the year, allow us to determine the overall level of satisfaction of our Customers and their willingness to recommend our Bank to others. Due to the fact that the satisfaction level information is complemented by Customers’ comments, we are able to conduct more comprehensive analyses being a point of reference for implementing improvements which contribute to further growth of satisfaction among our Customers with working with us.

According to the NPS relationship survey commissioned by Alior Bank and conducted in Q4 2019, the Bank’s relationship NPS score was 29.

In addition, we would like to emphasise that, according to the results of the Monitor Satysfakcji survey carried out by ARC Rynek i Opinia, Alior Bank ranks second in terms of the pace of growth of NPS in 2017-2019.

NPS recommendation indicator

ARC Satisfaction Monitor – Pace of growth 2017-2019

At the same time, we conduct systematic surveys of NPS levels for particular products and distribution channels on Customer groups who have had direct contact with them prior to the survey, which provides us with more precise awareness of how Customers assess certain aspects of the Bank’s operations that are of interest to us. The outcomes of particular surveys are immediately presented to those responsible for the operation of the respective product or distribution channel, together with information on the underlying factors and measures that can be taken to achieve improvement.

Regarding the surveys of distribution channels, we also conduct regular surveys of satisfaction with the quality of service in our branches and in partner outlets.These surveys cover Customers or at least have a personal account or deposit, or have conducted a transaction, or have taken a loan, who have visited our branch or our partner’s outlet.

NPS results, upon verification, are immediately presented to those responsible for the operation

of particular products and distribution channels, heads of the branches, and owners of partner outlets through dashboards which enable them to carry out comprehensive analysis of the information, and makes it possible to promptly respond to any worrying symptoms. In addition, the Customer Relationship Department holds regular meetings with the owners of the surveyed products and processes in order to discuss in detail the outcomes and to take measures to improve customer satisfaction. Such meetings provides feedback and better understanding of the influence of particular events on the NPS level in particular areas.

Systematic NPS surveys have allowed us to focus our activities on key aspects indicated by Customers. Surveys conducted in 2019 show that convenience is the most important aspect for our Customers – about one-third of the Customers, in assessing the Bank in the relationship survey mentioned convenience as a factor which determines their assessment. The next places are taken by pricing and human-dependent aspects.

VOC 360

To be able to listen intently to Customer voices, the bank has developed a VOC (Voice of the Customer) 360 tool which broadly describes Customer contacts from such areas as: call centre, complaints handling, or social media, and allows us to conduct a thorough analysis. This tool presents trends in the number of customer queries in particular areas of Bank’s operations, thus supporting the recommendation process and development of products which are more customer-friendly. Through this implementation, we have been able to launch a full „Close the loop” process by which we collect and analyse customer voices, and then take measures and deliver initiatives to improve customer experience with our Bank.

Thorough analysis of the information provided by the VOC tool allows us to determine how our measures impact on customers and at the same time show how the number of Customer queries decreases in the wake of the improvements implemented by the Bank.

To learn the opinion of business operators on Alior Bank’s solutions for companies and to even better adapt our offering to business needs, in 2019 Alior Bank has established a Business Customer Council which is an advisory body consulted when creating new products and services and when streamlining processes for the business community.

The Business Customer Council Comprises about 100 business customers who regularly meet members of the Management Board of Alior Bank, business representatives responsible for products, risks and operations.

Customer experience

In 2019, we continued our efforts to develop processes and products in such a way as to make them simple, convenient and as expected by our customers. Any changes that we implement result not only from our NPS surveys, VOC 360 information, monitoring of the banking market, but also comments of our Customers received through a dedicated tab on the bank’s website, called Strefa Klienta (Customer Zone).

Improved quality of service

We have implemented research of the quality of service in our brick-and-mortar channel – in branches and partner outlets – using the Mystery Shopping method.This research is conducted regularly and is aimed at continuous measurement and verification of the level of compliance with standards, the quality of any sales talk, and we experience of potential customers during visits at Alior Bank. This research has covered both the Consumer and Business Customer segments. The results allow us to diagnose critical areas of interaction with Customers. These results are used by the Bank’s units involved in the development of sales talk standards and by the Employees of Branches and Partner Outlets, providing valuable feedback from the Customer point of view.

Since early 2019, Customers in selected Branches and Partner Outlets can read the provided newspapers and magazines when waiting for service. After a pilot conducted early in the year which provided positive feedback, we decided to spread the project onto our sales network. This allows our Customers to have a good time when waiting for service at outlets with the largest transactional volumes. Meanwhile, we conducted a pilot project of making available a Wi-Fi network to customers in selected branches.

Regardless of which contact channel with the Bank the Customer chooses, we want to communicate with them in clear and intelligible way, without banking jargon, clearly presenting what we want to convey. We have conducted a communication simplification project which covers letters, individual and mass mailing – including provisions in contracts and Rules & Regulations so that to make them unambiguous for the audience. In terms of communication simplification, this year war was devoted to building competences of plain language of all workers responsible for customer communication. We have carried out a number of workshops which involved a total of 217 people from 32 teams. We conducted the inventory and analysis of communications mailed to our customers, focusing on the most voluminous documents. Based on this analysis, we work out new standards in communication, template letters, contracts and Rules & Regulations. A handbook is being prepared which will standardise the new practices. Employees will be able to use it as a manual, to be able to quickly apply new rules. Behind us is also a project kick-off meeting at which a linguist presented the outcomes of analysis, and we have taken key decisions for our bank related to the simplification of letters and legal texts.

Development of self-service

In 2019 we have launched throughout our branch network 194 iKiosks – innovative online workstations for Customers. This equipment provides Consumers and Business Customers with access to Alior Online, Kantor Walutowy (Currency Exchange Bureau) and BusinessPro.

iKiosks, being part of digital transformation of Branches, provide support and play an educational role for Customers. During the onboarding, bankers help in the first login, demonstrate the potential of our online banking and encourage to systematic use of it, e.g., to make online transfers without waiting in queues. In addition, due to making available in iKiosks of the documentation required by Article 111 of the Banking Law, we have removed the necessity of printing out dozens of pages of paper documents.

The availability of iKiosks in Branch Outlets increased the number of Customers logging in to online banking.

At the same time, we worked on the development of the Cash Deposit Machine (CDM) network – what’s more, we took care to educate those who have not yet had the opportunity to use this service.

We are aware that Customer expectations can vary, so we aim at creating such solutions by which everyone will find something for themselves. We appreciate customers who prefer self-service, at the same time being the driver for making our systems more modern and technologically advanced, by conveying their expectations towards what we offer to them. On the other hand, we focus our activities also on customers for which the Bank is primary a human contact. We respect our Customers’ preferences, try to support them on every stage of their contact with the bank, and educate them so that they consciously make the choice of the path on which to stay with us.

As Customer Experience Team, we take care that customers can stay at home while handling their affairs, e.g., by choosing our online banking or mobile banking systems, or contact with the Call Centre.

We work on solutions to minimise Customer’s effort due to such solution as “Secure Link” (Bezpieczne Połączenie) or direct Customer contact with a Call Centre consultant upon login to mobile banking. Such solution absolutely facilitates our Customers to obtain the necessary information or execute certain instructions.

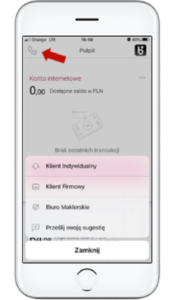

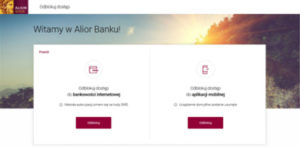

A breakthrough for the minimisation of Customer effort came with remote activation of access to online banking without the need to visit a branch office or contact the Call Centre. This allows our customers to fully tap remote services which we offer.

For Customers who have accidentally locked their PIN to the card, we have implemented a functionality of self-unlocking the PIN on the same day by changing the same.

For Customers who have accidentally locked their PIN to the card, we have implemented a functionality of self-unlocking the PIN on the same day by changing the same.

We also make effort to support our Customers in transition from the analogue to the digital world. We are committed to what is called digitisation of our Customers by educating them how easy it is to bank on your own or from any place and at any time. As part of education, we have introduced active use of the text message channel to inform our customers about: insufficient amount to repay a cash advance, or conditions which make them eligible for waiver of charges for the account and the debit/credit card, not only for the existing Customers but also for those who have only begun working with us.

Our efforts are reflected in the area on quality rankings, such “Newsweek Friendly Bank” and “Company Friendly Bank”, where Alior Bank has occupied the leadership role for several years now.

Customer Problem Lab Alior Bank Customer Ombudsman

Any suggestions or queries submitted by Customers to the Bank through various channels, e.g.: in letters to the Management Board, to the PR Department, through social media, on the phone, or directly at the company’s offices, are forwarded to a specially established unit called Customer Problem Lab (CPL). It is a “rapid response team” which aims to immediately (typically within 48 hours) solve Customer problems and prevent them from occurring in the future.

And the same time, we continue the recommendation process consisting in analysing the problems important from the point of view of: Customer, reputation risk, financial risk and operational risk. The main purpose of the process is to identify key problems, effectively work out and implement recommendations and corrective action on them. Elimination of problems helps to reduce the number of complaints by eliminating the most important causes, which results in increased Customer satisfaction.

The Customer Problem Lab (CPL) team analysed more than 100 cases having effect on Customers. The analysis led to modification of the processes to make them more Customer-friendly and eliminated a large part of the queries. This measures have translated into a downward trend for the number of complaints submitted to the Bank..

In addition, there is a Customer Ombudsman at the Bank. The Customer Ombudsman is the last appellate instance in the complaint process. An appeal to the Ombudsman may be lodged where the response to the complaint so far and any potential appellate procedures do not meet the Customer’s expectations. The activity of the Customer Ombudsman contributed to increased feeling of security among our customers due to efficient and objective verification of any problems submitted by them. In 2019, an Ombudsman’s dashboard has been created which identifies any improvements to be made, which additionally supports the recommendation process.

Facilities for business customers

Alior Bank’s offering for companies was expanded to include virtual cards which assist businesses in managing significant volumes of online payments. They have no plastic form, but they operate only in the online environment as part of the Smart Data service which enables customers to generate a single card number for each transaction. Such solution ensures confidentiality of data and high level of transaction security.

Facilities for business customers

Alior Bank’s offering for companies was expanded to include virtual cards which assist businesses in managing significant volumes of online payments. They have no plastic form, but they operate only in the online environment as part of the Smart Data service which enables customers to generate a single card number for each transaction. Such solution ensures confidentiality of data and high level of transaction security.

Alior Bank offers to businesses:

The existing offering of contactless payments for companies in the form of Apple Pay and Google Pay was supplemented in 2019 with Garmin Pay (Garmin watch) and Fitbit Pay (FitBit watch) payments.

Pursuing its „Digital disruptor” strategy, the Bank made available the possibility of processing of the financing through its new loan app called Feniks KB. In the Biznes Financial Package, the company receives under a single decision as many as five financing forms to choose from. The amount can be divided into: non-revolving credit, overdraft facility, credit card, factoring, and leasing. Such solution enables the customer to spend money for any of the various needs related to their business activity. Under its new offering for businesses, the Bank has increased the funding amount to PLN 3 million, at the same reducing the loan origination decision to 20 minutes. For the convenience of businesspeople, the application for funding has been integrated into current account opening, card ordering, and activation of access to e-banking. The offering is addressed to micro-, small and mid-sized enterprises.

In 2019, we have also developed an offering for services which are complementary to banking services, on the zafirmowani.pl platform dedicated to businesspeople. The portal makes available to customers, among other things, a questionnaire tool which helps the users to select the form of their business activity. In addition, businesses holding a company account at Alior Bank can connect to the www.zafirmowani.pl portal directly from the online banking level (without additional login). Due to automatic mechanism of pairing the account history with accounting documents, the customer can also check in the accounting module the status of invoice payments.

In 2019, conferences and webinars were held by the Bank as part of „Akademia zafirmowani.pl”. The zafirmowani.pl portal is increasingly a primary website address where to find comprehensive tools for establishing, running and developing your own business activity.

Comprehensive offering and quality of service made Alior Bank in 2019 reach the top of Newsweek and Forbes rankings. The Bank took 1st place in the Newsweek Friendly Bank ranking in the „Mobile Banking” and „Online Banking” categories, as well as in the Company-Friendly Bank ranking.

In its strategy, Alior Bank has always identified innovation as a key area of its business. It is in response to changes in external environment, increased pace of new technology solutions emerging and growing expectations of customers for the Bank’s innovation – in 2018 Alior Bank has built an internal structure – RBL_Innovation by Alior Bank. The new brand is fostered by the Innovation and FinTech Department with its 6 teams: Fintech Partnership Team, Open Banking Team, Blockchain Competence Centre, and Innovation Lab which is responsible for prototyping, UX research, and service design. The objective of RBL_Innovation by Alior Bank is to build two ecosystems: internal and external ones. The former is responsible for testing, creating and moderation of the building of innovative solutions. The latter, external one, is responsible establishing partnerships with fintechs, accelerator, open banking development strategy, as well as investing in fintech, regtech and insuretech companies. Just within one year RBL_Innovation by Alior Bank was recognised by Global Finance magazine as one of 25 best innovation labs worldwide, and the acceleration programme RBL_START carried out by the Partnership Team was nominated to BAI Global Awards 2019. The Innovation and Fintech Department closely works both with the strategy department and with business divisions – Consumer, Business Customer, as well as with the subsidiaries, by recommending and selecting projects which meet the business priorities defined in Alior Bank’s development strategy.

Only during the year RBL_Innovation by Alior Bank was recognized as one of the 25 best innovation laboratories in the world by the Global Finance magazine, while the RBL_START acceleration program implemented by the Partnership Team was nominated for the BAI Global Awards 2019.

The Innovation and Fintech Department closely cooperates with both the Strategy Department as well as business divisions – Individual client, Business client, as well as subsidiaries, recommending and selecting projects that correspond to the business priorities set out in Alior Bank’s development strategy.

Alior Bank’s internal ecosystem is created by the Innovation Lab, or a team dedicated to designing and testing ideas for new solutions. The process is so designed as to provide each unit of the bank with professional support on the conceptual, prototyping and user testing stages, before it creates a business plan and applies for project funding.

The testing team at RBL_ is responsible for searching for new ideas and demand from users. It is focused on user experience, or building positive experiences in the Bank’s customers. It regularly tests prototypes of new and existing digital solutions, ensuring their adaptation both to user expectations and business needs. In 2019, 30 research projects were carried out, involving 200 respondents who tested prototypes prepared by UX teams.

The Service Design Team provides coherence and commitment in the process of solution creation by using a full gamut of techniques to design of larger and smaller changes improving customer experience. A total of more than 120 workshop days were held in 2019.

The Digital Services Designer Team sees to the functionality and aesthetic qualities of the proposals to be developed. It ensures the compliance of the solution with best practice and trends in the digital world. Due to creative and experimental nature of the innovation process, a large part of designers’ work is spent on building models and prototypes for testing with potential users. Support to the internal ecosystem of Alior Bank is provided by the activities of the Innovation Lab team, which are focused on transforming the culture of the entire organisation. Through such initiatives as RBL_BRAIN, a crowdsourcing platform, and RBL_SPARKS, a mentoring programme, the team moderates, encourages and sparks innovative perspective in the employees and builds their digital competences. Five projects were carried out under the RBL_BRAIN initiative, which involved 1675 employees of the Bank. Almost 200 ideas on how to respond to business challenges were proposed.At the same time, educational initiatives were conducted, including RBL_SPARKS, which build competences in the innovation design area among employees from different areas of the organisation.

One of the units of the Innovation and FinTech Department is the Blockchain Competence Centre. The task of the team is to top the properties of distributed information repositories to create solutions with high level of security and transparency. In Q2 2019, this technology has been implemented in a tool used for the authentication of public documents delivered to the bank’s customers, such as: rules and regulations, tariffs of charges and commissions, or interest rate tables. The Bank’s customers have gained a transparent solution which is in compliance with regulatory requirements, and Alior Bank has made a significant step forward in digitisation of document flows. In carrying out this project, Alior Bank has been one of the first in the world and the first in Poland financial institution to use the public blockchain technology.

The Blockchain Competence Centre also conducts educational activities and dissemination of this technology by participating in presentations, conferences, in the work of the Group for Distributed Repositories at the Ministry of Digitisation, as well as by holding Blockchain Club meetings. It is an initiative that involves not only Alior Bank employees, but also market experts interested in using this technology. In addition, dedicated training on the operation and application of the blockchain technology were conducted both for the bank’s employees, and for other institutions, such as the KNF.

The external ecosystem is built based on open banking, partnership agreements with third-party companies, fintechs, startups or through investment projects carried out by Alior Bank’s investment vehicle.

The Open Banking Team is responsible for the implementation and development of open banking strategy at Alior Bank. In 2019, it has implemented a number of projects resulting from the PSD2 Directive and the Payment Services Act becoming effective, by which banks were required to make available a testing environment and publish production interfaces to ensure a connection with the services of access to information about the accounts and payment initiation. Alior Bank has enabled universal use of the testing environment through its Developers’ Portal in March 2019.In June, the Bank has published an API set with access to production data, which can be used by authorised service providers. At the same time, due to obtaining, as the second bank in Poland, an authorisation for the provision of services in the Third-Party Provider’s (TPP) role, the Bank has started to work on tapping the opportunities provided by access to the data held by other banks. Towards the end of 2019, the first service using the API of the largest Polish banks has been launched in the loan origination process. In 2020, further integration with banks are scheduled, as is the use of these interfaces for offering new solutions for Alior Bank’s customers. Work will also begin on new APIs by Alior Bank to offer them on the commercial terms to institutional customers and third-party service providers.

The Open Banking Team is responsible for the implementation and development of open banking strategy at Alior Bank. In 2019, it has implemented a number of projects resulting from the PSD2 Directive and the Payment Services Act becoming effective, by which banks were required to make available a testing environment and publish production interfaces to ensure a connection with the services of access to information about the accounts and payment initiation. Alior Bank has enabled universal use of the testing environment through its Developers’ Portal in March 2019.In June, the Bank has published an API set with access to production data, which can be used by authorised service providers. At the same time, due to obtaining, as the second bank in Poland, an authorisation for the provision of services in the Third-Party Provider’s (TPP) role, the Bank has started to work on tapping the opportunities provided by access to the data held by other banks. Towards the end of 2019, the first service using the API of the largest Polish banks has been launched in the loan origination process. In 2020, further integration with banks are scheduled, as is the use of these interfaces for offering new solutions for Alior Bank’s customers. Work will also begin on new APIs by Alior Bank to offer them on the commercial terms to institutional customers and third-party service providers.

Another project which was being developed throughout 2019 by the team of RBL_Innovation by Alior Bank is the Bank’s special-purpose vehicle which has executed two transactions during that time. One of them is the continuation project investing in PayPo, a Polish fintech which offers deferred payments for online shopping. This project has confirmed dynamic development and good prospects of the first investment project carried out in 2018. In addition, in December 2019, the investment vehicle has completed another transaction. Jointly with PKO BP and BNP Paribas banks and two venture-capital funds, the vehicle invested in Autenti company. It is an entity which offers a platform for electronic signing of agreements and digital document flow. It is the first such joint and equal-footing transaction of such a type carried out by banks in Central and Eastern Europe. The Autenti investors are eager to have established cooperation with the banking community, which could support the creation of a Polish standard for, both, remote signing and digital circulation of documents, and thus the development of environmentally friendly solutions in this regard.

Partnership agreements on business or pilot collaboration with partners from the fintech segment is another area of activity of the Innovation and FinTech Department team whose task is to bring to Alior Bank innovative solutions, services and technologies.

In 2019, a total of 15 contracts with fintechs were made, including 8 projects under the RBL_START acceleration programme.

In 2019, more than 200 companies from all over the world applied in the second edition of this banking startup programme, of which 11 companies have been accepted as they responded to the bank’s business challenges related to the building of the main relationship with customers, advanced data analysis, and acquisition of new channels through which to offer banking products. The operative partners of the RBL_START programme in 2019 were: PZU, Linklaters, Mastercard, Microsoft, IBM.

In Alior Bank, we have always taken care that our products and services get to the people who really need them and for whom they are a real value. We strictly comply with the Unfair Sales Prevention Policy which prevents misselling practices. We have defined the rules for proper construction and distribution of products. We have limited the product shelf, and the selected items from our offering may be distributed only through authorised channels (e.g., Private Banking) and by employees holding appropriate knowledge and experience. We have systematically monitored the sales process for misselling risks. We have defined rules of proceeding with any identified mis-selling cases. All staff have also completed training on the rules of transparent sales.

In 2018 we conducted a series of training courses for branch employees (Road Show) during which experts from the Bank’s Headquarters have explained in detail the requirements for responsible sales in the area of investment products. Sales bonuses for employees depend on the quality of the sales process, which we regularly control. The primary mechanism here is post sale customer surveys (so-called Post Sale Calls) for products involving the highest risk of mis-selling, and this is complemented with the assessment of the quality of documentation, complaints and so-called early resignation of customers.

Throughout the Group, we take care to enhance cybersecurity competences of the employees. All employees are required to undergo training in this regard, thus raising their competences and awareness of the existing threats. In 2019, we actively tested the effectiveness of such training, through various simulated socio-technical attacks on our employees which demonstrated a satisfactory and ever increasing level of awareness and skills in correct responding to threats among the Bank’s employees.

Security of data and customer transactions

The security of the funds entrusted to us and of our customers’ data are our highest priority. That’s why throughout the Alior Bank Group strict security procedures are in place to ensure confidentiality, integrity and availability of the processed information. Our security policy and all procedures in this area are updated as required in response to changing cybersecurity conditions in the market, as well as new requirements and guidelines of regulators. In the cybersecurity area, we have conducted both prevention and detection. In 2019, we have upgraded our Data Leakage Prevention (DLP) systems, which makes us even better prepared to limit the risks related to data security incidents.

As an operator of the key service, in keeping with the National Cybersecurity System Act (implementing the requirements of the NIST European directive), the bank has carried out a project of adaptation to that act, achieving full compliance with its requirements. All key systems were subjected to extensive audits and security tests, which provided us with assurance that customers’ data and funds at Alior Bank are secure. The safety of data and customer transactions is also monitored 24/7 by a team of highly qualified experts.

Our cybersecurity experts have not only tracked down active new threats, but also analysed trends in this area and on this basis they modified and adapted the security systems.

In 2019, the bank also actively worked with the industry in the area of cybersecurity – both with other banks and with the Banking Cybersecurity Centre at the Polish Bank Association, getting involved in the work of many working groups or forums (e.g., Payment Transaction Security Forum, Threat Intelligence Forum).

Due to such comprehensive approach to cybersecurity, in 2019 the bank reported no major data security incidents and stood out with particularly high security of transactions which translated into a negligible level of transactional fraud.

Protection of personal data of our Customers and thus of the data covered by bank secrecy count among the Bank’s priorities. The Bank is the controller of personal data of millions of Customers and processes such data for various purposes, of which sale-related purposes are the most important, though not the only ones. We are committed to the protection of our Customers’ privacy. Since the entry into force of Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 95/46/EC (hereinafter referred to as “GDPR”), the Bank has modified its approach to data protection. In compliance with the GDPR, the Bank focuses on the assessment of data processing risk as soon as in the initial design phase (privacy by design) and evaluates the effects for data processing of all new relevant processes and projects.

In May 2019, the Act of 21 February 2019 amending certain acts in connection with ensuring the application of the GDPR came into force. This Act amended the provisions of such acts as for instance the Banking Law, Labour Code or act on providing services by electronic means. These amendments required the Bank to adjust to new provisions, among which the most important ones in the Banking Law area were: to ensure the right to information about the factors that influenced the credit decision and ensure the right to human intervention in loan-related automated decision-making. The amendments applied also to the processing of Bank employees’ data as regards video surveillance regulating, change of the extent to which the employer processed personal data or matters related to the Company Social Benefits Fund. We monitor legislative amendments and regulatory guidelines on an ongoing basis to quickly respond to any changes in this area and ensure compliance.

The GDPR has been in force for over a year and a half and we have observed constant, even growing interest in personal data protection, both on the part of natural persons and on the part of legal persons and other entities which since 2018 have begun to pay more attention to the subject. Probably it is caused by huge financial penalties that can be imposed by the data protection authority and the giant GDPR-related publicity, but also by growing awareness of what a valuable commodity data and information are in the 21st century.

The Data Protection Officer’s e-mail box available on the Bank’s website receives thousands requests from Customers related to their rights resulting from the GDPR as well as other questions regarding data protection. Letters from our Customers and the regulator give us credit for ensuring the rights which arise from the GDPR in a timely and substantive manner.

Secure electronic banking

As a „digital disruptor”, we are aware that technology progress and digitisation of financial services come with new threats appearing daily in the market, which we need to anticipate and tackle. That’s why in 2019 we have provided our customers with increased security of access to the account by implementing strong authentication in the banking login process, and we have made available secure and convenient authorisation of operations using PUSH messages in the mobile app. We have also adapted our online banking to the requirements of PSD2 directive.

We have also expanded our systems which monitor and protect the funds of customers in electronic banking (e.g. FDS – Fraud Detection System or Malware Shield). They incorporate a number of improvements (some of them are proprietary and unique in the market) which allow us to even better respond to the existing and future threats to electronic banking. We have also adapted these systems to new challenges and threats from „open banking” provided for by PSD2. We have also expanded the operation of the FDS system onto electronic banking dedicated to business customers (BPro), replacing the previous system there with a single centralised, state-of-the-art antifraud solution.

We are aware that transaction security also depends on online behaviour of our customers, that’s why the Bank has conducted an extensive campaign about new threats addressed to customers in social media, through dedicated email communication, and on our web pages.

In 2019, the bank also supported an educational action on cybersecurity, called „Bankers for Education”, organised by the Polish Bank Association and Warsaw Banking Institute. The action was to promote awareness on cyber security, electronic economy and electronic payments.