Community and neighbourhood responsibility

Community involvement

The Group has no formal procedures or policies in place to govern the topics of the effect on the neighbouring community, however, acting by the rules of corporate social responsibility is for us very important and we set great store by support to the local community initiatives. Social responsibility accompanies us virtually from the very inception of our activity.

In 2019, we provided more than PLN 300,000 for social causes.

Special CSR area at the Bank is sophisticated culture which is invariably associated with us among customers since our inception. In the area of social responsibility it means for us a commitment to support initiatives to promote culture and prevent social exclusion by supporting the access to cultural or sporting values. We try to be close to the events which are important for the Poles.

As an institution laying emphasis on corporate social responsibility, Alior Bank has been involved in a wide range of initiatives, both on a local and on a nation-wide scale for years. Such activities aim not only support to the execution of particular projects, but also dissemination of knowledge in the area of social responsibility and sustainable development among employees, customers, business partners and shareholders of the Bank.

In 2019, as part of employees volunteering programme called “Engaged in helping”, almost 80 various events and social activities were delivered, in which the Bank’s employees were involved.

At least 780 people took part in all the activities. It should be however noted that some of the activities were open in nature and were not recorded – such activity was, among others, the collection of the necessities for those in need, or the “Give a Present” initiative, under which employees prepared Christmas gifts, which engaged more than 1300 people.

An estimated of about 3500 hours were devoted to social action, of which more than 2000 hours was during working hours, and 1500 was private time of our employees.

In 2019, more than 7% of the employees engaged in volunteering (as compared to more than 1% in 2018).

During 2019, many actions initiated in prior years where continued, such as:

- Educational action for children and young people carried out as part of the “Banking Is OK” project which involved more than 100 people;

- Workshops preparing our employees to the fairy-tale educator role, as part of the Zaczytana Akademia (Engrossed in Reading Academy), a project carried out together with our strategic partner, Zaczytani.org Foundation, which involved 69 people, thus expanding to almost 100 people the group of volunteers engaged in the project. Notable is the activity of our staff from Rzeszów, where, on their initiative, an “Engrossed in Reading” Academy project will be launched at the local hospital;

- The Christmas “Give a Present” initiative, as part of which employee respond to letters with the needs and dreams of the pupils of social partners with which we work. More than 1300 people from all over Poland were engaged in the last years’ action. The “Give a Present” action consisted in preparing Christmas presents for more than 360 beneficiaries, including children and young people from childcare centres, children with cancer, people with disability, lonely old people, people in the homelessness crisis or in a very tough living circumstances. As part of the action, we worked with 19 community organisations selected and reported to us by our stuff.

In 2019, there were also new important activities in the community area. We put very large emphasis on building the awareness of social responsibility and engagement in the local activities among our staff. As part of the programme to develop the competences of the staff of the service network, we have delivered a project called “Development-Zappy – Engaged in Helping”, to which we invited 110 employees from all our sales regions. These people took part in an educational workshop devoted to Sustainable Development Goals, and then independently prepared and delivered local community projects. These people were taking decisions on selecting the beneficiary of the action, social partners selected for collaboration, the targets of the action and how to deliver it. In this is way, 15 projects were established and delivered, the purpose of which was to prevent social exclusion of children and young people from childcare centres, people with disabilities, seniors, people in difficult living circumstances, as well as project geared towards the promotion of sports and healthy lifestyle, projects for the environment and animals.The objective of the project participants was also to promote social engagement among employees of the regions and their relatives, i.e., assuming the ambassadors’ role. Thus, almost 200 employees got involved in the activities.

The programme was established for the best staff of the sales network to enhance not only their business competencies, but also to build their awareness of what is social responsibility. These employees became ambassadors of employees volunteering in their respective regions.

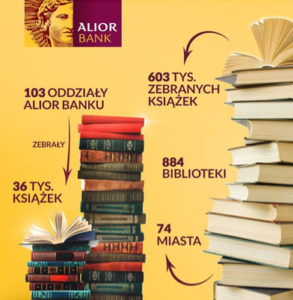

As strategic partners of Zaczytani.org Foundation, we got involved in the  action carried out by our partner, called “Grand Collection of Books”. The collection was conducted not only among the bank’s employees, but also involved almost 100 branch outlets which play the role of open points of collection where anyone can bring with them the books intended for the action. In this way, we have collected more than about 36,000 books which were then transferred to our partner, Zaczytani.org Foundation.

action carried out by our partner, called “Grand Collection of Books”. The collection was conducted not only among the bank’s employees, but also involved almost 100 branch outlets which play the role of open points of collection where anyone can bring with them the books intended for the action. In this way, we have collected more than about 36,000 books which were then transferred to our partner, Zaczytani.org Foundation.

Volunteers from the Bank who are also “fairy-tale educators”, took part in the Polish Language Festival sponsored by Alior Bank, as part of which they conducted educational activities for the youngest participants of the festival, as well as educational activities for their parents. The activities for the youngest people lasted one hour in six days, and for the adults – one hour in five days.

A very important social activity which should be mentioned, implemented with the participation of the bank’s volunteers, was Poland’s first Social Ideathon “Chcieć to MOC” (Will is POWER). This event was held by nine companies allied within the Human Explorers initiative. The purpose of the event was to work out new solutions to improve the employment situation of people with disabilities. Integracja Foundation was the social partner of the event.

Twenty-five hours of work, almost 100 participants, nine different companies, 12 creative solutions to improve the job situation of people with disabilities.

Poland’s first event held by nine companies allied within the Human Explorers initiative – Social Ideathon. The purpose of the event was to work out new solutions to improve the employment situation of people with disabilities. Integracja Foundation was the social partner of the event. Our collaboration was to show to the world a new form of social engagement – competences and creative support of a social partner in carrying out its community activity.

In 2019, we noted increased interest in social activities as a team-building tool among the Bank’s employees. On the initiative of particular units, refurbishment projects were delivered for the places of community activity of seniors and childcare centres, rehabilitation of green areas of healthcare facilities, and actions to promote healthy and active lifestyle.

Under „Do It Yourself” projects, we supported the development of creative competencies among our staff by holding actions by which they produced themselves items for community purposes, such as e.g., making Christmas cards for lonely seniors, as well as floristic workshops which involve the seniors, preparation of scratchers for cats staying in shelters, stuffed toys for children from child care centres, as well as making Christmas decorations for a charitable fair which was held in December 2019.

We immensely enjoy growing interest in community activity among the Bank’s employees. We perceive employee volunteering both as a way of taking social responsibility, but also as a tangible tool to develop the competences of our employees. We promote and support a vast majority of the initiatives taken by our employees. We consider this the delivery of the value of our company which is teamwork.

Other sponsorship activities

In 2019, Alior Bank became a nationwide partner of the 12th Cavalcade of the Magi in Poland for the fourth time in a row.

The Bank also took sponsorship of the fifth edition of the “Polish Language Capital City Festival” in Szczebrzeszyn which was held in August. This event got the rank of one of the most important literary festivals in Poland.

In October 2019, Cracow hosted the 5th European Cybersecurity Forum – CYBERSEC 2019, and Alior Bank was its strategic partner. This event figures into several Alior Bank’s strategic areas – innovation and security. It’s the third sponsorship of that event by Alior Bank in a row.

The Bank also sponsored sporting competitions as part of Private Banking activity. We continued the activities started in 2018, by extending partnership to golf tournaments held by PGA Polska (Golf Coaches’ Association). These tournaments are attended by wealthy people qualified to do Private Banking segment – top managers, businesspeople and celebrities.

In 2019, as a continuation of cooperation with the Polish Football Association, Alior Bank supported Poland’s Football National Team as its official partner.

It’s another time that Alior Bank sponsored the Rock Legend Festival in Dolina Charlotty. Six concerts were organised during the Festival, including: John Fogerty, Foreigner, Thirty Seconds to Mars or The Australian Pink Floyd Show. The Festival attracts each year flocks of fans from all over Poland.

In September 2019, Alior Bank also supported the “Przemysl Five for the Hospice” Run – a local event with enjoyed great interest in the region.

In Alior Bank, we appreciate every entrepreneur and are well aware of the role small- and middle-sized enterprises play in the Polish economy.

We know the biggest problems and complaints of the companies and we know that the lack of funding is usually a major obstacle. This applies in particular to newly established companies and enterprises carrying out innovative projects, including delivery of the results of research and development.

We have carefully noted to the Government „Strategy for Responsible Development until 2020” which mentions supporting SME access to capital as an activity to be taken in the years to come. We are proud to emphasise that Alior Bank actively participates in government programmes supporting SME development.

In 2019, zafirmowani.pl, which is Alior Bank’s online portal for micro-enterprises, has developed an offering for services which are  complementary to banking services. The portal’s users got access to entrepreneur’s questionnaire which helps businesspeople to select the format of business activity they want to pursue. New users can also apply for a company account and payment terminal already during the registration process on the portal. Small enterprises using the online accounting app can also use online collection services and microfactoring services. The users of the portal also had the opportunity to participate in webinars and conferences held in physical locations all over Poland. The meetings were conducted by renowned experts from various areas related to business activity. What’s more, users of www.zafirmowani.pl holding a company account at Alior Bank can connect to the portal directly from the online banking level (without additional login). Due to automatic mechanism of pairing the account history with accounting documents, the customer can also check in the accounting module the status of invoice payments.

complementary to banking services. The portal’s users got access to entrepreneur’s questionnaire which helps businesspeople to select the format of business activity they want to pursue. New users can also apply for a company account and payment terminal already during the registration process on the portal. Small enterprises using the online accounting app can also use online collection services and microfactoring services. The users of the portal also had the opportunity to participate in webinars and conferences held in physical locations all over Poland. The meetings were conducted by renowned experts from various areas related to business activity. What’s more, users of www.zafirmowani.pl holding a company account at Alior Bank can connect to the portal directly from the online banking level (without additional login). Due to automatic mechanism of pairing the account history with accounting documents, the customer can also check in the accounting module the status of invoice payments.

Supporting Polish enterprises in getting funding

Alior Bank has for several years now expanded its participation in public programmes, both those financed from EU funds and national funds. This allows us to expand and make more attractive offerings for customers, especially small and medium-sized enterprises (SMEs). A very significant part of funding awarded to companies by Alior Bank have been loans secured by Bank Gospodarstwa Krajowego (BGK) using public (national and EU) funding. Alior Bank has provided, among others, loans with BGK guarantees as part of the National Guarantee Fund (this continues the de minimis programme); under COSME and Creative Europe programmes. For loans backed up with a guarantee, customers benefit from alternative ways to secure their intended funding and often there is no need to present any security such as mortgage or fixed assets – a significant part of the risk is taken over by the guarantor (e.g., BGK).

Alior Bank has been also a leader in sales of COSME guarantees. Since 2015, the bank has awarded more than 15,500 COSME guarantees for a total amount of PLN 3.5 billion. In 2019, the Bank awarded PLN 1.9 billion worth of loans secured with this instrument.

Almost 90% of new sales of loans for customers from the micro segment and 50% of customers from the segment of small companies are secured with guarantees offered in collaboration with Bank Gospodarstwa Krajowego.

The offering of guarantee programmes also includes special guarantees addressed to innovative enterprises, creative sector, agricultural and food-processing sector or telecom sector customers.

Biznesmax guarantee

Currently, the most attractive loan repayment security for SMEs is  Biznesmax guarantee, available under the portfolio guarantee line of the Guarantee Fund of the Smart Growth Operational Programme. This product is a unique combination of a guarantee with a grant.

Biznesmax guarantee, available under the portfolio guarantee line of the Guarantee Fund of the Smart Growth Operational Programme. This product is a unique combination of a guarantee with a grant.

The guarantee is free throughout the entire lending period, which can be even up to 20 years, and secures as much as 80% of the lending amount (up to the equivalent of 2.5 million euros), and Alior Bank transfers the benefit from securing the repayment of the loan to the customer in the form of a low margin as compared to the same loan without the Biznesmax guarantee. In addition, upon correct completion of the investment project, the Customer may apply for a grant in the form of a refund of a part of, or even entire interest paid for the initial three years of loan repayment.

This guarantee is addressed to enterprises carrying out investment projects with innovative potential at least on the company scale, as well as for those who intend to carry out pro-environmental projects, e.g., the installation of photovoltaic panels, thermal insulation of the company building.

Alior Bank has been the first bank in Poland to award in 2017 the first loan with such guarantee, and in 2019, also as the first bank in Poland, it paid the first aid to one of its customers who had used that guarantee.

In July 2019, Alior Bank was the first to offer the Creative Europe guarantee as part of the agreement signed with BGK with EFI counter-guarantee. This guarantee supports customers from the broad creative and cultural industries, including such industries as audiovisual production (including films, television, video games and multimedia); radio, visual arts, music, literature, performing arts, publishing, translation, design and festivals. Due to specific features of the intangible value produced by this sector and the lack of real property or machinery to be offered as a security for a loan, the sector has had problems getting a bank loan. Creative Europe guarantee filled the gap in this regard. Thanks to Alior Bank’s offering, two initial customers used this security in 2019.

Like other loan repayment guarantees, the Creative Europe guarantee allows the customer to reduce the loan margin and the collateral up to 80% of the lending amount (maximum of PLN 8.4 million). It is provided for revolving and non-revolving working capital loans and investment loans.

FGR guarantee

Towards the end of 2019, Alior Bank entered into a contract with BGK under which customers will have the opportunity to apply for free security for their investment projects. The Bank has been one of the first institutions to award a loan secured with this guarantee, for an unprecedented guaranteed amount of almost PLN 5 million. Agricultural Guarantee (under the Agricultural Guarantee Fund) – a guarantee addressed to the agricultural sector and food processors who want to grow by improving their competitiveness versus the Polish and foreign industry.

Guarantee for telecoms

As part of the broad range of Alior Bank’s products, customers can count on support in obtaining EU funding in the form of loan commitments, bridging loans or a technology loan.

Under its „European Packag”, Alior Bank has been offering comprehensive support to projects with EU grants distributed through the PARP, NCBiR, Ministry of Development, Regional Self-Government Offices. From a loan promise for EU grant loan to bridging loans, i.e. ones that pre-finance the grant and loan for own contribution, i.e. eligible costs not covered by the grant, loans for non-eligible costs, and loans for VAT financing. With supplementing costs, the Bank proposes to and encourages customers to use the Biznesmax guarantee, which, because it is free, reduces the loan margin and gives the opportunity to get refund of interest for the initial three years of repayment, is very attractive for the customer and supports Poland’s spending of EU funding under programmes of the financial perspective for 2014-2020.

A very popular grant programme is a loan for technology innovation, for which Alior Bank has signed a cooperation agreement with BGK in 2015. A customer implementing its own or acquired results of research & development projects can receive non-refundable technology bonus at up to PLN 6 million, and up to 80% of the eligible costs of the technology investment project.

In 2019, the Bank issued loan commitments for a total amount of PLN 95 million, and loans with EU grants, including technology loans, were awarded for PLN 61 million.

Since 2017, Alior Bank has also been a financial intermediary which distributes public funds in the form of repayable instruments. The offering is addressed to telecoms registered with the Electronic Communication Office (broadband advance) and to Housing Communities, Housing Co-operatives, Social Housing Societies and Local and Regional Governments (thermal insulation advance).

Offering for telecoms

A broadband advance is a preferential funding addressed to telecoms, awarded under the Digital Poland Operation Programme for 2014-2020 (POPC). Alior Bank offers two types of Broadband Advance: for investment and for liquidity. The investment advance can finance projects of construction, expansion or upgrade of fibre networks which provide high-speed Internet connection, i.e., at least 30 Mb/s. The liquidity advance is for investment and working capital purposes.

By the end of 2019, Alior Bank awarded funding under the broadband advance for a combined amount of PLN 75 million. Customers which have received funding in this form include micro- and small enterprises from all over Poland.

In addition, for this customer group, the Bank has offered security for commercial loans both for investment projects and for working capital in the form of POPC guarantee. This is an alternative for customers who fail to meet the conditions for being granted a broadband advance.

Funding of thermal insulation projects

Since more than two years, Alior Bank has offered a Thermal Insulation Loan. It is an attractive opportunity to finance energy-saving projects in multi-family residential houses, addressed mainly to housing co-operatives, housing communities and Social Housing Societies. The loan, co-funded from EU funds (under regional operational programmes for 2014-2020) and Alior Bank’s own funds, has been now offered to investors from Lower Silesian, Lodzkie, and Podlaskie regions.

In 2019 Alior Bank was also awarded a grant from the European Investment Bank to support the funding of thermal insulation projects in multi-family residential buildings, which provides for, among others, refund of 90% of documentation costs to be obtained by the Customer applying for the thermal insulation loan.

Thanks to very attractive financing terms, the managers of multi-family residential buildings more often carry out such investment projects, which translates into greater energy performance of buildings, reduces CO2 emissions, and improves the quality of the neighbourhood.

More than 20 entities took opportunity of this offer by the end of 2019, which included both housing communities and housing cooperatives.

Reaching with the offering of repayable instruments to customers who search for preferential funding forms was possible due to working with many institutions and sectoral organisations associating telecoms (including The Electronic Communication Office, „Digital Poland” Projects Centre, National Ethernet Communication Chamber, E-South Association) and Managers of Property, Executive Boards of Housing Co-operatives and Social Housing Societies (including National Energy Conservation Agency, Association of Energy Auditors, Auditing Association of Housing Co-operatives, National Chamber of Commerce, Associations of Property Managers

Alior Bank brings no significant direct adverse effects on the environment, yet despite the absence of formal environmental policy does the bank pays special attention to environmental topics in its philosophy. Each year, we have consistently achieved lower consumption of utilities, which significantly contributes to reduced emissions of greenhouse gases.

The idea of a “paperless bank” has been consistently carried out, which allows us to reduce paper consumption every year. In Alior Bank we use tap water, which significantly reduces the generation of waste in the form of plastic bottles.

Last year, the Bank started the process of upgrading its branch network where we use environmentally friendly materials for upgrades of our space, such as e.g. felt, which, in addition to natural fibre, also includes fibre from processed plastic. The materials used for the manufacture of certain furniture are from processed yoghurt cups, of which the tabletops of bankers’ stands are made. To light up all rooms in the revitalised branches, we have used LED fixtures which are energy efficient and consume little power. Together with the new lightning, sensors are being installed to measure the quantity of daylight. The purpose of such sensors will be to constantly adapt lightning power of the fixture to legally required standards. Search solution will directly translate into lower power consumption.

Consumption of materials and utilities at Alior Bank Group

| Paper | [tonnes] | 174 | |

| Heat | [GJ] | 97711 | |

| Electric power | [MWh] | 18430 | |

| Fuel oil | [tonnes] | 41 | |

| Petrol | [tonnes] | 229 | |

| Diesel oil | [tonnes] | 775 | |

| Natural gas | [m3] | 104681 | |

| Water | [m3] | 27863 |

The new face of a branch

In 2019, the Bank opened an entirely new kind of branch in Jana Pawła II Ave. in Warsaw. One of this branch’s main assumptions is to increase efficiency. Separated zones and selection of adequate solutions allow to customise our services even better.

The first zone, that is customer service one, comprises for instance a comfy  welcome space where Customers will find organic coffee and tea and filtered water. Nearby there are service desks equipped with tools allowing to perform any operation. Separated both in visual and in acoustic terms, they give a sense of comfort and provide discretion needed at any bank.

welcome space where Customers will find organic coffee and tea and filtered water. Nearby there are service desks equipped with tools allowing to perform any operation. Separated both in visual and in acoustic terms, they give a sense of comfort and provide discretion needed at any bank.

Then, in the digital zone, Customers may, with a banker’s assistance, try out online banking and mobile application, log in for the first time and check how these solutions work. Right beside it, Customers may see the other,  non-business face of the Bank, which engages in charity actions and supports culture, arts and sport. In this section, the Bank presents its social activities. Customers may also count on a banker’s help when using the ATM/CDM located at the branch entrance. The next zone are meeting rooms where Customers can make an appointment with a banker for an individual conversation. These acoustically separated rooms are dedicated to meetings with Customers that require more confidentiality and privacy. Glass walls of such an office are covered with graphics preventing identification of people inside. These rooms, just like the service desks, have all necessary equipment.

non-business face of the Bank, which engages in charity actions and supports culture, arts and sport. In this section, the Bank presents its social activities. Customers may also count on a banker’s help when using the ATM/CDM located at the branch entrance. The next zone are meeting rooms where Customers can make an appointment with a banker for an individual conversation. These acoustically separated rooms are dedicated to meetings with Customers that require more confidentiality and privacy. Glass walls of such an office are covered with graphics preventing identification of people inside. These rooms, just like the service desks, have all necessary equipment.

Another zone is bankers’ working space, inaccessible for Customers. It has  a screen where bankers can for instance check hours for which each meeting room is booked. Additionally, the branch has a separated room for phone calls, with special acoustic felt stands. This way bankers may talk to Customers in quiet and comfort.

a screen where bankers can for instance check hours for which each meeting room is booked. Additionally, the branch has a separated room for phone calls, with special acoustic felt stands. This way bankers may talk to Customers in quiet and comfort.

For the branch, materials and products from local suppliers were used. To a large extent, these are recycled materials. Examples are desktops made from processed yoghurt cups or upholstery and ceilings made from recycled PET bottles. Furthermore, furnishings are partially made of wood from fast-growing trees.

The branch is designed to limit resource utilisation. More daylight is available in the space and LED lights installed adjust their brightness and colour to the time of day. The branch offers filtered tap water – both sparkling and still. Coffee and tea served at the branch come from organic farming and beverage serving accessories are 100% biodegradable.

Till the end of the year, the Bank plans to open

30 such outlets all over Poland.